Unlocking Homeownership with No Deposit Home Loans

Sick of renting? For many aspiring homeowners, the daunting hurdle of saving for a deposit often stands in the way of their dreams. Enter the solution: No Deposit Home Loans which have revolutionised the homeownership landscape, offering a pathway for individuals to make their dreams a reality without the need for a substantial upfront deposit. Let’s delve into how these loans work and how they can benefit prospective homeowners.

Buyers Agent Service

The low upfront fee of 2% of the principal is paid in exchange of a buyers agency service. Our No Deposit Loan Lender will assist you in sourcing, negotiating on your behalf to purchase the home of your dreams, at a great price. This is beneficial to the buyer as you have an expert on your team helping you buy a property at the best price possible.

The Deposit

A No Deposit Home Loan is a second mortgage which simply works like a personal loan to enable you to have the ability to pay a deposit. A traditional Home Loan serves as a registered first mortgage, recognised and accepted by respected lenders such as Westpac, Qudos and Resimac, streamlining the borrowing process. This means that individuals can access the funds they need to secure their dream home with ease. Whether you are PAYG or self employed we can help you enter the property market.

No Lender’s Mortgage Insurance

One of the most significant advantages of No Deposit Home Loans is the absence of Lender’s Mortgage Insurance (LMI). By lending at an 80% Loan-to-Value Ratio (LVR), you are spared the burden of hefty LMI fees, making homeownership more accessible and affordable.

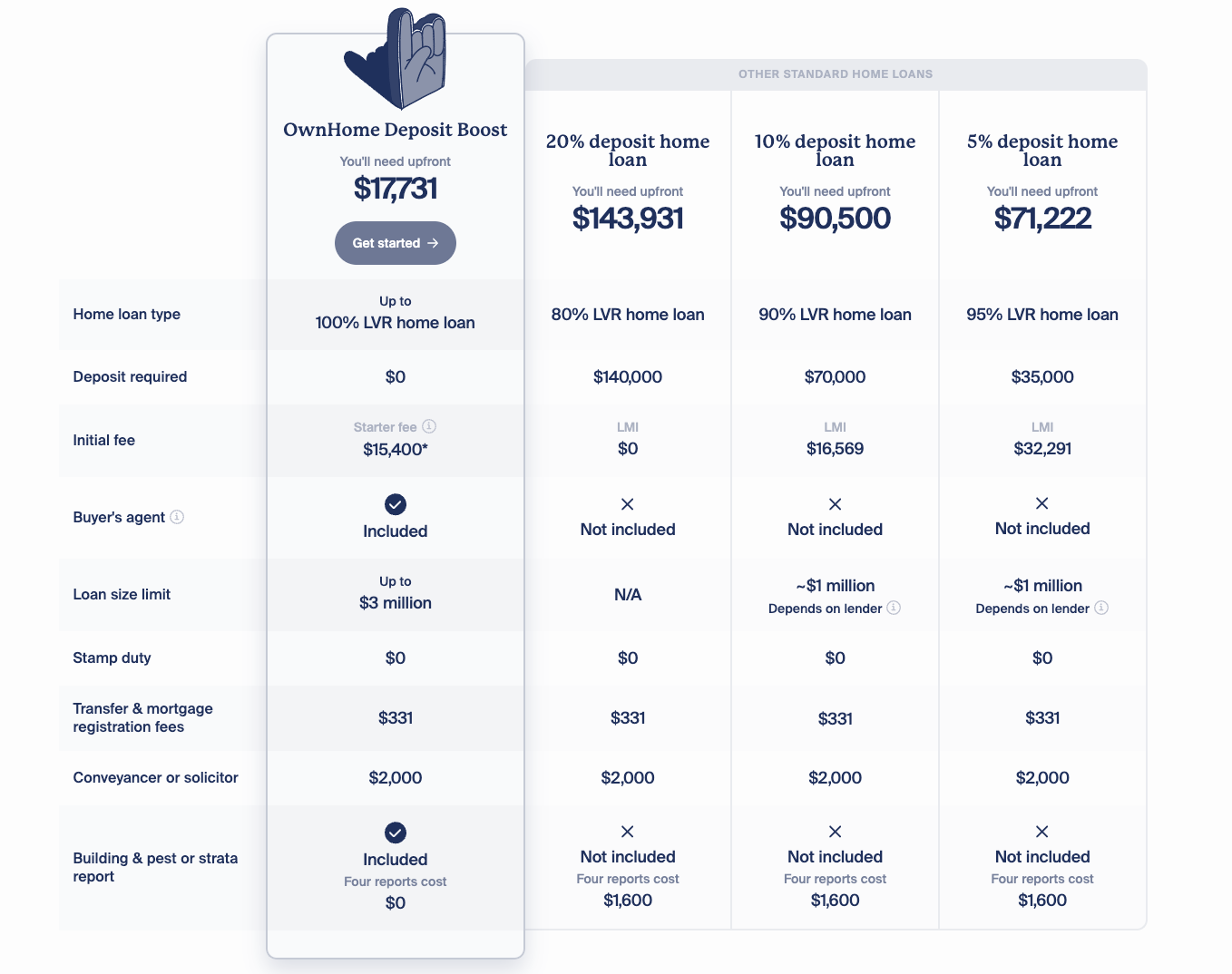

Savings on a No Deposit Loan on a $700,000 Property as a First Home Buyer in NSW

See what you can save and enter the property market by utilising a No Deposit Home Loan in comparison with a tradtional lenders in the table below.

Savings on a No Deposit Loan of a One Million Dollar Property in NSW

See what you can save and enter the property market by utilising a no deposit home loan service in comparison with a traditional lender in the table below.

Building Equity

With a 15-year term on the No Deposit Home Loan, you can swiftly build equity in your homes, establishing a solid financial foundation for the future. This accelerated equity growth sets individuals on a trajectory towards long-term financial security.

Client Satisfaction

There are no early repayment or exit fees on the no deposit boost loan, providing flexibility and freedom to refinance when the time is right.

3 EASY STEPS TO APPROVAL

1. Pre-Approval for an No Deposit Home Loan : 100% online. Enjoy the convenience of receiving pre-approval in under 48 hours (for PAYG customers).

2. Pre-Approval with Resimac Westpac or Qudos: This streamlines the application process, expediting the journey towards homeownership.

3. Stay Informed: Throughout the application and home hunt, remain informed every step of the way. You are kept updated on the progress, providing peace of mind and reassurance during this significant life milestone.

In conclusion, No Deposit Home Loans offer a lifeline to aspiring homeowners, removing the financial barriers that often stand in the way of property ownership. With streamlined processes, favorable terms, and unparalleled client satisfaction, these loans pave the way towards realizing the dream of homeownership. So, take the leap, unlock the door to your dream home, and embark on a journey towards a brighter, more secure future.